The Accounts Report has been designed to import direct into accounting software packages; Sage or Xero. The Showing Scene team are not accounting experts, but the report has been created with advice from those that are and we therefore recommend that if you are unsure in the use of these reports, you speak to your own accountants for advice.

Setting Up

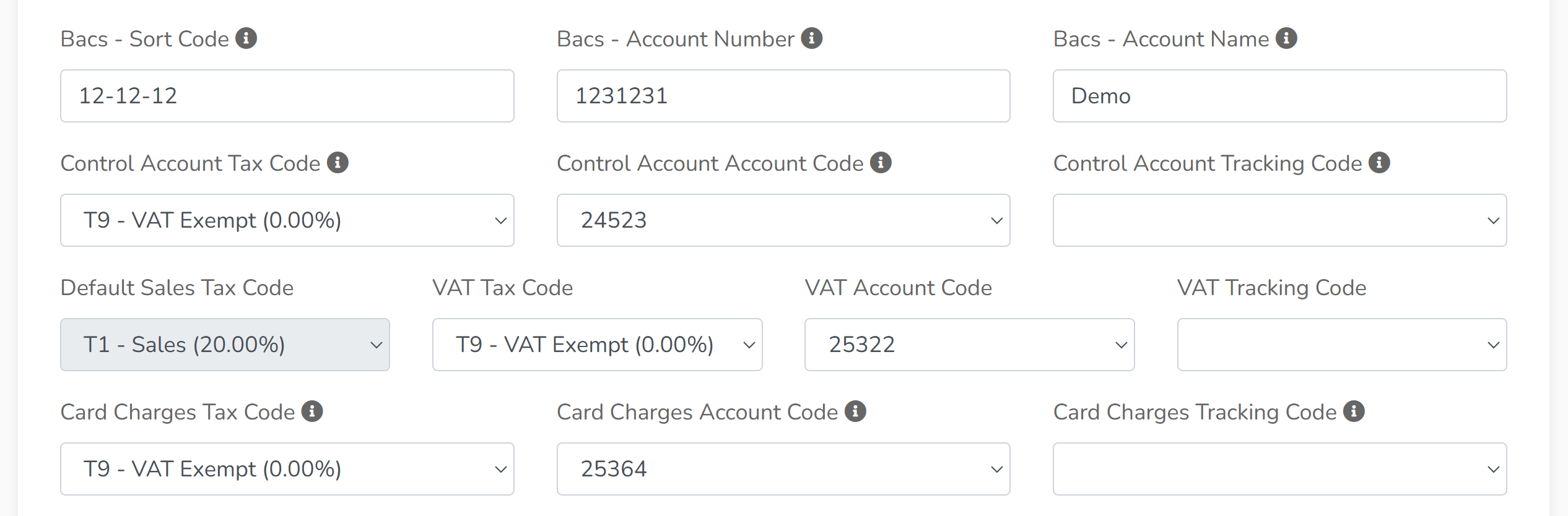

1. It's important to check that your organisation profile has been set up to add in tax codes, accounts code and tracking codes wherever your accountant feels you require them. These codes are found in the 'Edit Profile' section of your organisation and can be seen below:

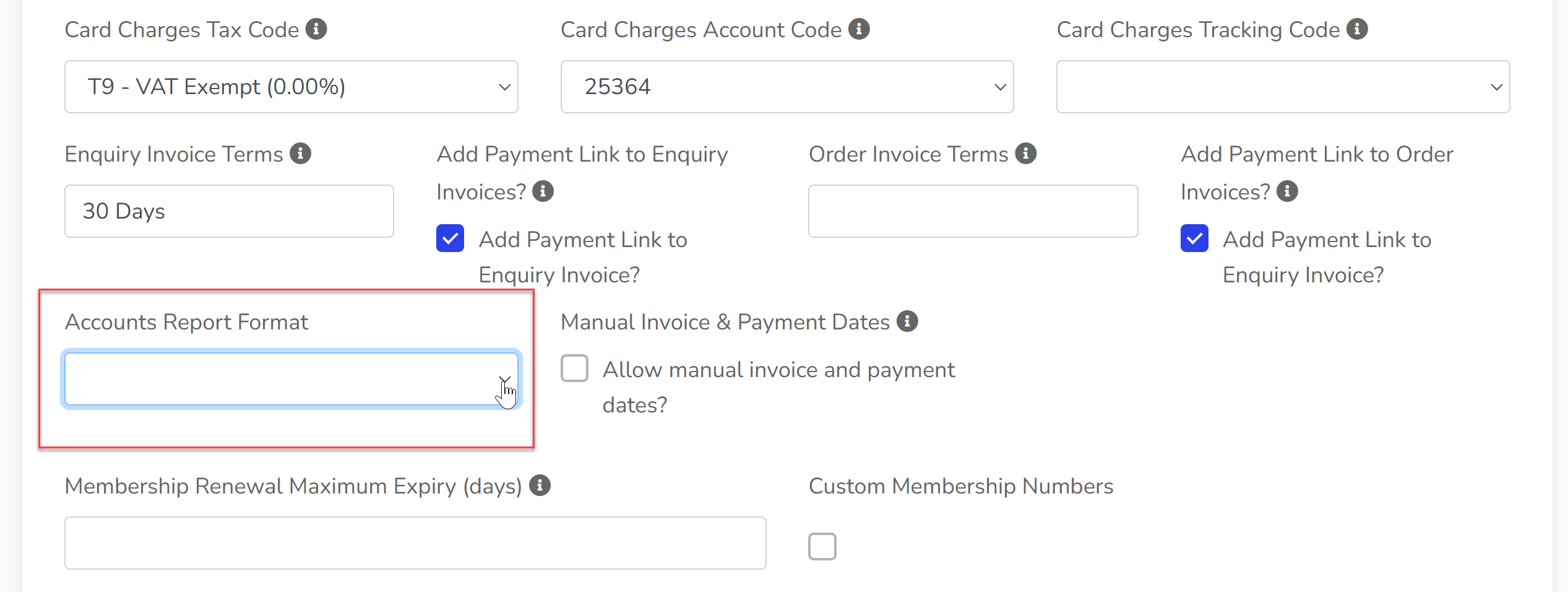

2. Within the 'Edit Profile' section, you can also change your default Accounts Report type by using the dropdown menu shown below to make your choice from 'Sage Journals', 'Sage Invoices' or 'Xero Invoices'. This can be changed at a later date.

3. Across the system, wherever a product is available for purchase (section, trade stand, event extra etc.), there is the opportunity to input accounts codes & tracking codes. These can be added as per the advice of your accountant.

Generating your Accounts Report

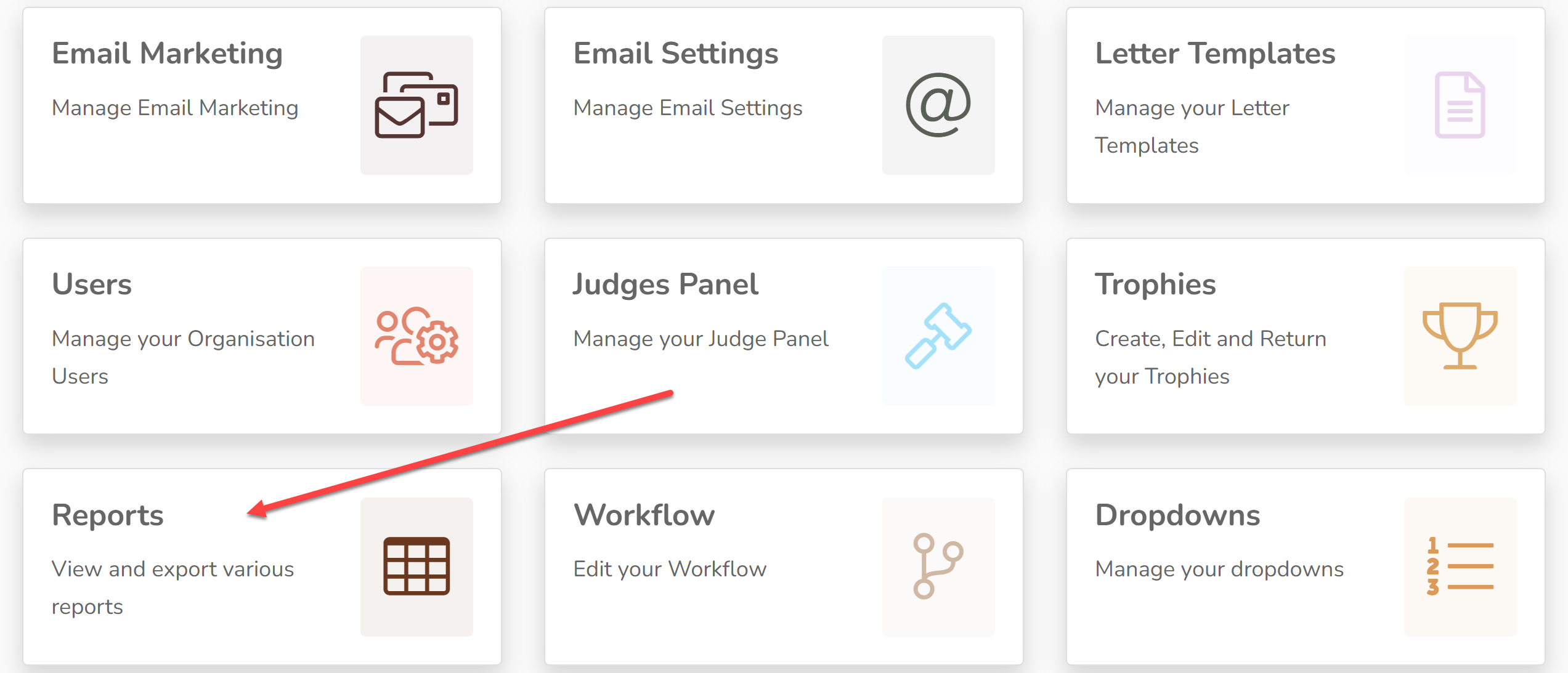

1. Go to your CRM and click 'Reports'.

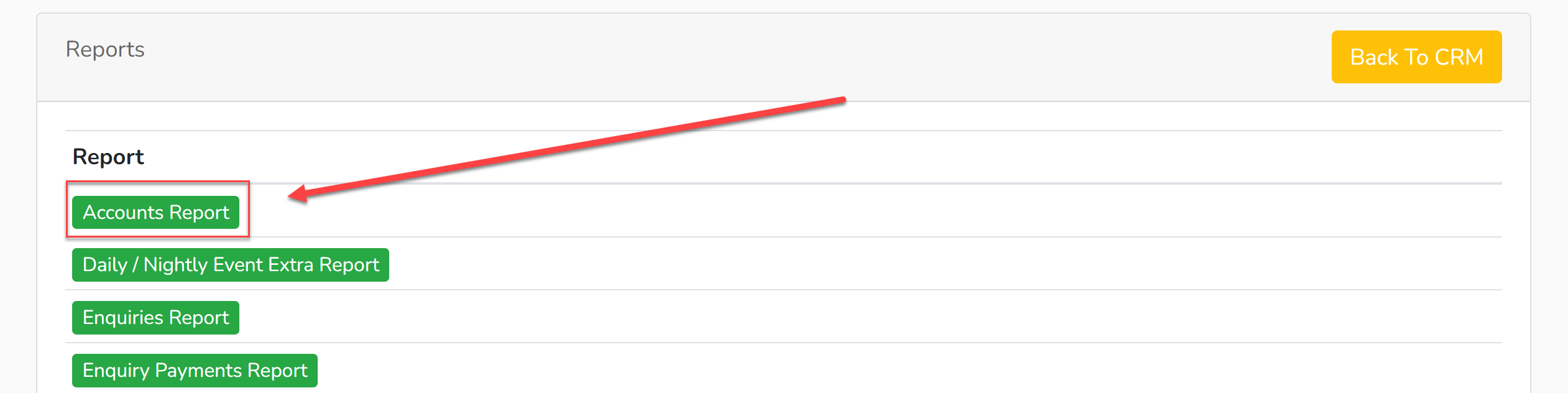

2. Click 'Accounts Report'

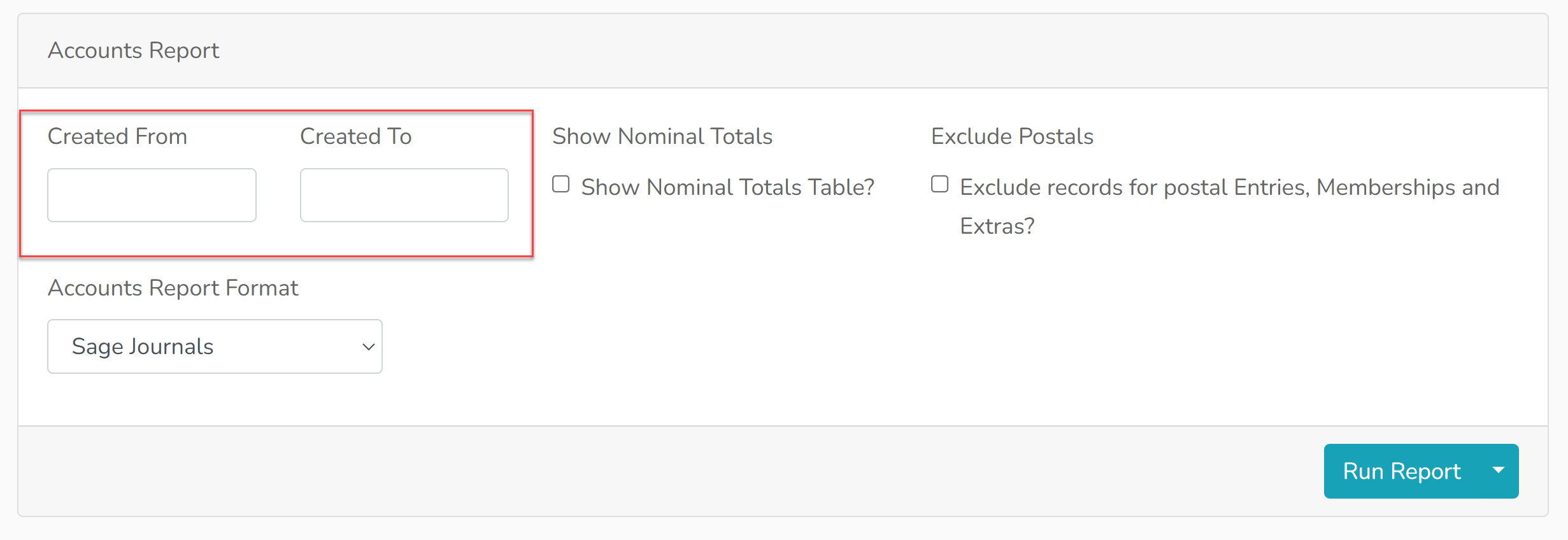

3. If you wish to run the report for certain dates, input those dates here:

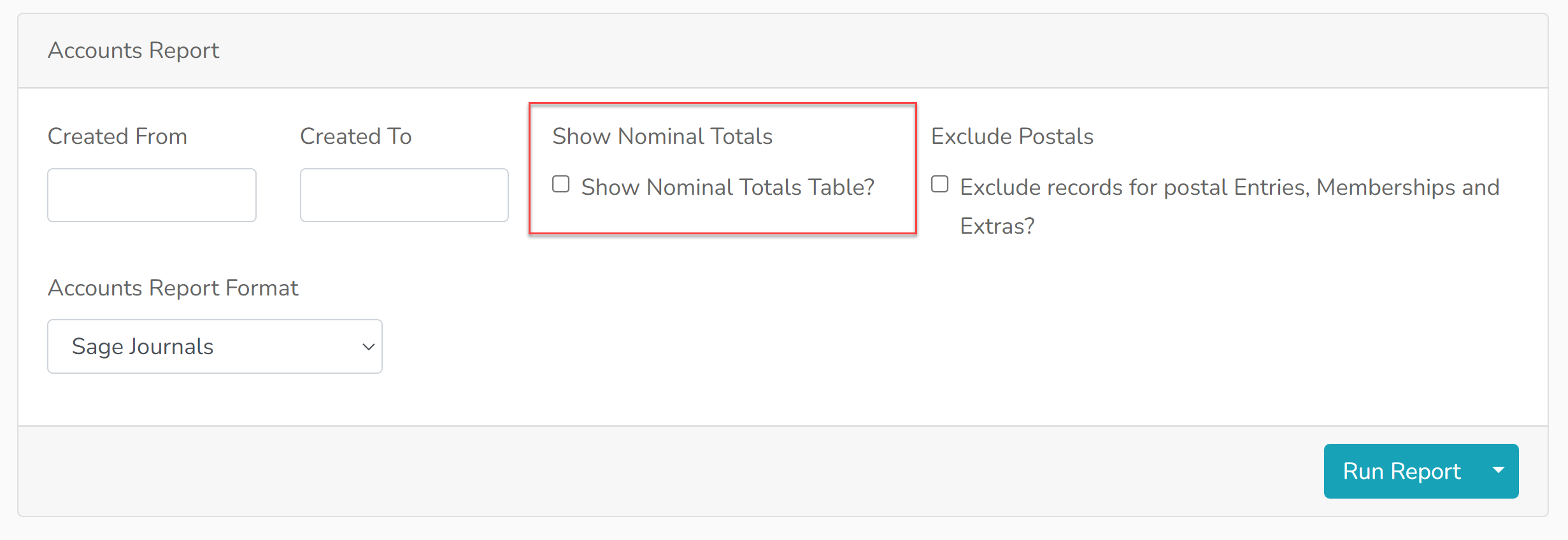

4. By selecting 'Show Nominal Totals Table' it will produce a table at the top of your report with payments grouped by nominal code.

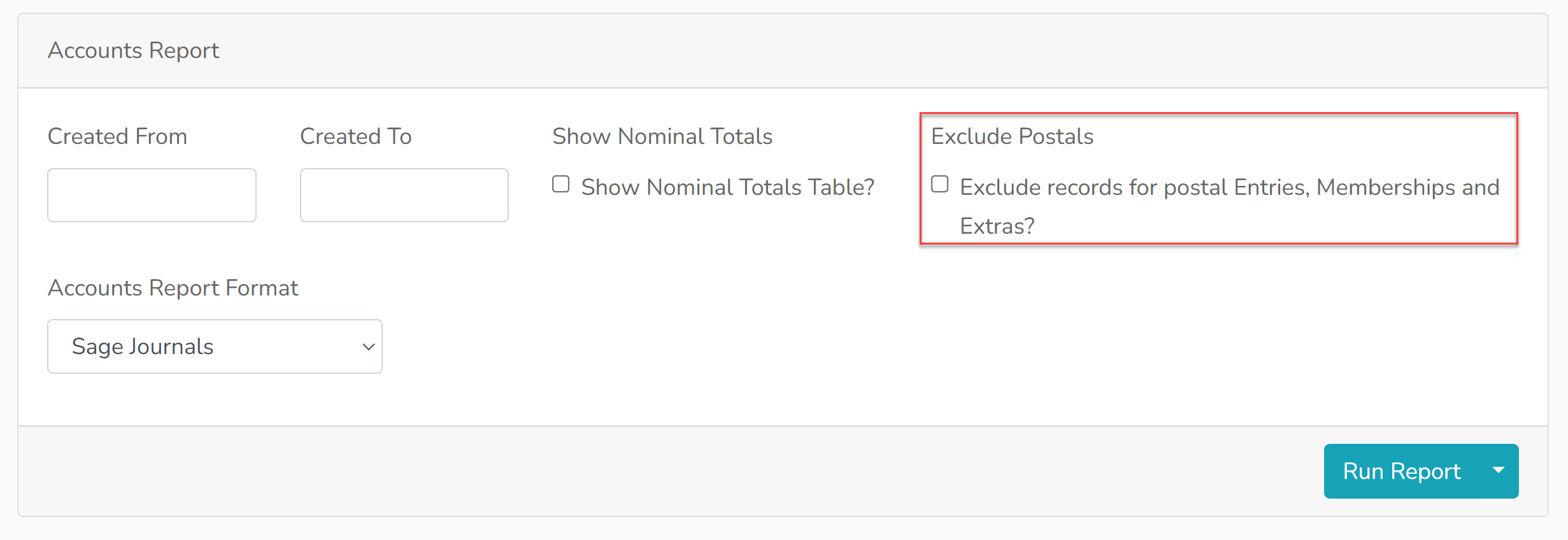

5. There is the option to exclude some postal reports from the account.

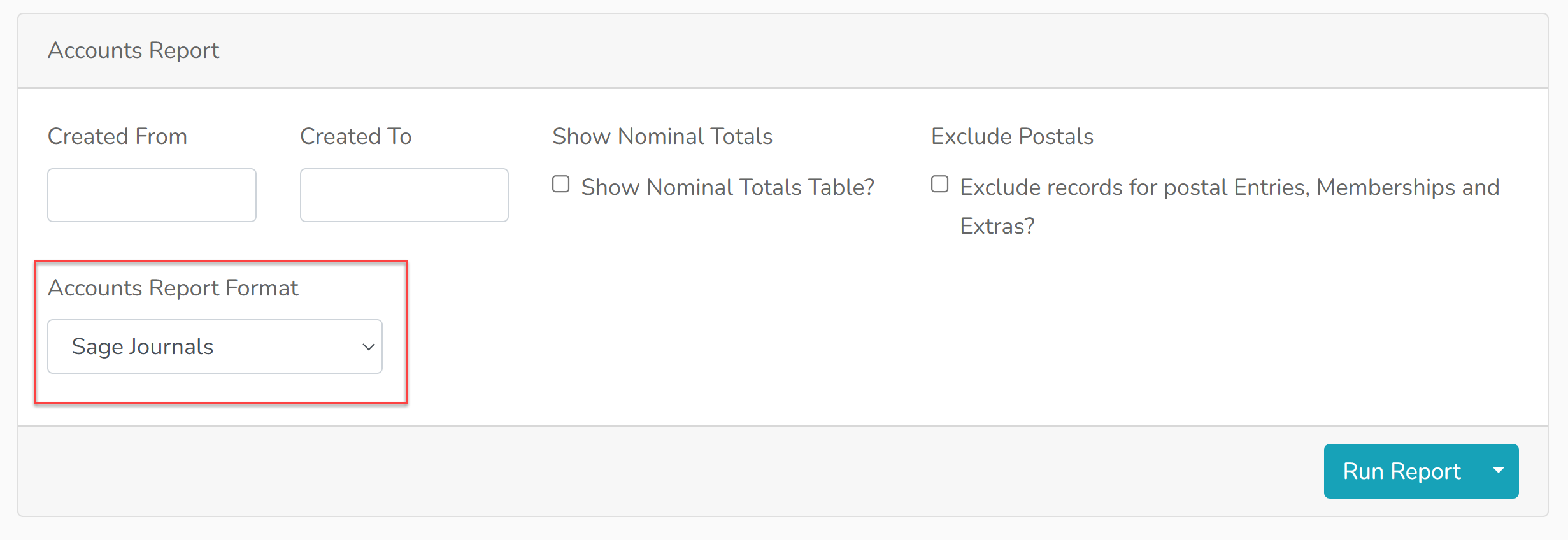

6. The dropdown menu gives you the option to change the format of your Account Report.

7. Click 'Run Report' to view the report in Showing Scene or use the dropdown menu and select 'Export to Excel' to download an Excel spreadsheet which can be imported direct into your accounting software package.

Additional Note

- Trade and sponsorship will only appear in the Accounts Report once an invoice has been raised. Invoices must be raised for the income to appear in the Accounts Report.